As we navigate the final quarter of 2025, the precious metals market is ablaze with unprecedented momentum. Gold coin prices in 2025 have skyrocketed, with spot gold trading at approximately $4,143 per ounce as of October 23—marking a staggering 51.56% increase from the same period last year. This surge isn’t just a fleeting rally; it’s a structural shift propelled by a perfect storm of economic, geopolitical, and policy factors. For investors eyeing investment-grade gold coins like American Eagles or Canadian Maple Leafs, understanding these drivers is crucial to capitalizing on the opportunity.

Universal Chemical Trading (UCTR-GmbH) stands at the forefront as one of Europe’s, the USA’s, and South America’s leading suppliers of premium gold coins for investment. With a robust network ensuring secure, competitive sourcing of bullion gold coins, UCTR empowers collectors and investors alike to secure their assets amid this volatile landscape. In this in-depth analysis, we’ll unpack the key forces behind the gold price surge 2025, forecast future trajectories, and explore why now is the prime time to diversify into tangible gold.

Central Bank Buying: The Unyielding Demand Engine

Central banks have emerged as the bedrock of this year’s gold bull run, with net purchases reaching 444 metric tons through August 2025 alone—a 15-year streak of accumulation. Led by heavyweights like China, Kazakhstan, and Turkey, these institutions are diversifying reserves away from the U.S. dollar amid deglobalization fears and currency debasement risks. China’s People’s Bank, for instance, added to its holdings for the 11th straight month in September, pushing reported reserves to 2,264 tonnes—likely understated for strategic reasons.

This relentless buying—projected to average 710 tonnes quarterly through year-end—directly inflates demand and premiums on physical gold coins. For gold coin investors, this translates to heightened value in sovereign mint products, where scarcity and authenticity command even greater premiums. UCTR’s expertise in sourcing these coins ensures clients access verified, high-purity options without the markup hassles of fragmented markets.

Geopolitical Tensions and Trade Wars: Safe-Haven Magnetism

No discussion of the gold bull market 2025 is complete without addressing escalating global risks. President Trump’s second-term tariffs—peaking at 100% on Chinese imports—have ignited trade uncertainties, depreciating the dollar and eroding investor confidence in fiat currencies. Coupled with ongoing conflicts in Ukraine and the Middle East, these tensions have funneled capital into gold as the ultimate safe-haven asset.

The result? A 65% year-to-date climb, breaching $4,000 per ounce in October. Gold coin prices mirror this, with popular denominations like 1 oz Eagles seeing premiums swell 15-20% due to collector flight-to-quality. In regions like South America and Europe—where UCTR excels in distribution—such volatility underscores gold’s role as a hedge against regional instability.

Inflation, Interest Rates, and Dollar Weakness: Macro Tailwinds

Persistent inflation and anticipated Federal Reserve rate cuts have further supercharged the rally. With U.S. deficits ballooning and real yields compressing, gold’s allure as an inflation hedge intensifies. The dollar’s worst start to a year since 1973 has amplified this, as a weaker greenback makes dollar-denominated gold cheaper for international buyers.

Investor demand via ETFs hit record inflows of $26 billion in Q3, pushing total assets under management to $472 billion. For buying gold coins online, this environment favors physical holdings over paper alternatives, as premiums on coins like Krugerrands or Britannias reflect both intrinsic value and numismatic appeal.

ETF and Retail Investor Surge: Broadening the Base

Beyond institutions, Western retail investors are piling in, with ETF holdings nearing 2020 peaks at 3,838 tonnes. Chinese household ETF demand has also exploded, signaling a grassroots shift toward precious metals amid economic slowdowns. This “debasement trade”—fearing high government debt and AI-driven market bubbles—has retail allocations to gold rising 41% year-over-year.

Consequently, 2025 gold coin trends emphasize fractional ownership for accessibility, with UCTR offering competitive pricing on everything from 1/10 oz coins to full sovereigns, catering to both novice and seasoned portfolios.

2025 Gold Price Forecasts: Where Do We Go From Here?

Analysts are bullish, with consensus pointing to an average of $3,000+ by year-end, though outliers like UBS forecast $3,800 and J.P. Morgan eye $4,000 amid sustained drivers. Looking to 2026, projections range from $4,500 to $5,441, fueled by ongoing central bank activity and potential recessionary pressures.

For gold coin price predictions 2025, expect premiums to track spot gains, potentially adding 5-10% value for certified pieces. However, risks like a surprise Fed hawkishness or resolved trade pacts could trigger pullbacks—emphasizing the need for strategic timing.

Navigating the Market: UCTR’s Commitment to Excellence

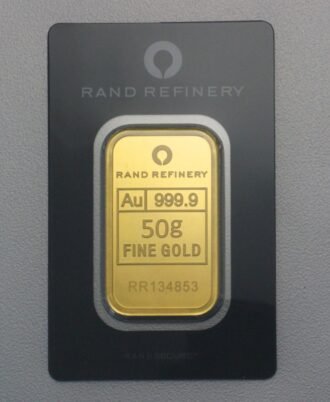

In this high-stakes environment, partnering with a trusted supplier is paramount. Universal Chemical Trading (UCTR-GmbH) leads the charge, delivering premium gold coins wholesale and retail across Europe, the USA, and South America. From American Gold Eagles to South African Krugerrands, UCTR’s vetted inventory ensures authenticity, competitive rates, and seamless logistics—ideal for hedging against the surge’s volatility.

Conclusion: Seize the Golden Opportunity in 2025

The gold price surge 2025—driven by central bank voracity, geopolitical storms, and macroeconomic headwinds—positions investment gold coins as a cornerstone of resilient portfolios. With prices defying gravity and forecasts gleaming brighter, now is the moment to act. Whether diversifying against inflation or safeguarding wealth, tangible gold offers unmatched security.

Explore UCTR’s unparalleled selection at Universal Chemical Trading and fortify your future today. In an era of uncertainty, gold doesn’t just shine—it endures.

Gold coin prices 2025, Gold price surge 2025, Investment-grade gold coins, Buying gold coins online,

Bullion gold coins, Gold bull market 2025, Gold price forecast 2025, American Gold Eagles, Gold coin investors, 2025 gold coin trends, Gold coins wholesale, Physical gold holdings, Gold coin price predictions 2025, Sovereign mint gold coins, Gold investment strategies 2025,

Leave a comment